Bulletin E-3508

Bulletin E-3508 Strategies for Purchasing Farm Inputs

DOWNLOAD

July 10, 2025 - Jonathan LaPorte

Are farm input prices better now or should you wait to make a purchase?

Answering that question presents quite a challenge. Historically, farms that prioritize purchasing inputs early will lower total input costs. However, long-term outlook for many markets can remain unclear if domestic and global uncertainty affect supply chains and product availability. In order to decide whether buying now is right for your farm, you need to think a bit more strategically about your buying options.

Each year you develop a crop plan that identifies what you will grow. Crop plans look at acres, yield goals, nutrient needs and pest concerns. While crop plans are not a new concept for most farms, they are an important part of being strategic and maximizing your use of available cash. Cash is often limited to working capital or loan funds. Since they are used for numerous purchases throughout the year, efficient use of these dollars is important.

This publication offers insight into strategic approaches to buying farm inputs. Insights include understanding market conditions, identifying farm needs, maximizing available cash and prioritizing what products to buy and when. We’ll also explore how to secure products at reasonable prices by creating an input purchasing plan. An input purchasing plan takes your crop plan and adapts it into an efficient buying strategy to obtain products at affordable costs. Borrowing from grain marketing concepts, input purchasing plans focus on being intentional and proactive about buying decisions.

What are Farm Inputs?

A simple definition of farm inputs is any resource used in the production of crops or raising livestock. A more complex definition is that farm inputs are the resources included when calculating your farm’s cost of production. For new or beginning farm managers, understanding what resources are commonly included in cost of production can be unclear or even confusing.

The Internal Revenue Service (IRS) defines cost of production as tax-deductible expenses listed on Form 1040, also known as a Schedule F (https://www.irs.gov/forms-pubs/about-schedule-f-form-1040). The list of inputs includes both variable and fixed costs that a farm may have in a year. Variable costs are purchases that can vary based on the farm’s production volume. While variable costs can be influenced by the production volumes, fixed costs are generally the same each year regardless of that volume. To learn more about cost of production, review MSU Bulletin E-3411: Introduction to Cost of Production and Its Uses (https://www.canr.msu.edu/resources/bulletin-e-3411-introduction-to-cost-of-production-and-its-uses).

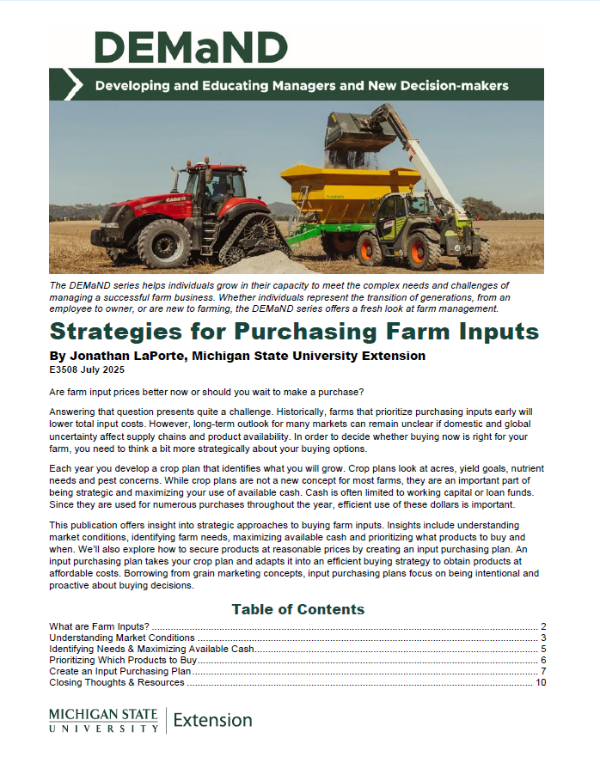

Farm inputs are often thought to focus specifically on variable costs. However, they can also include fixed costs as well. Key inputs for crops include seed purchases, fertilizer, pesticides, fuel, interest, labor, land rent, and property taxes. Key inputs for livestock include feed purchases, veterinary medicine, fuel, interest, labor, property taxes, and livestock purchases. USDA’s Economic Research Service (ERS) often tracks the trend in expenses of several key inputs (Figure 1).

Figure 1. Selected U.S. farm production expenses from USDA, Economic Research Service. https://www.ers.usda.gov/data-products/chart-gallery/chart-detail?chartId=82241

As Figure 1 illustrates, ERS attempts to forecast whether farm input costs will increase or decrease based on recent data. Understanding trends in expenses is one part of answering whether input prices are better now or later. Trends also provide a first look at market conditions.

Understanding Market Conditions

Understanding market conditions is essential when buying farm inputs. The available supply of products and demand, or need, for their use initially set market prices. Prices then move up or down based on different factors that affect supply and demand. Considering factors and their impact can help determine when to buy farm inputs.

Demand

Demand provides an indicator of value based on the amount farms want to buy. Farm inputs that are needed in large quantities tend to have a higher price.

For example, corn requires a large amount of nitrogen to maximize potential yields. Corn is a major crop grown across the country. If planting projections for corn acres is expected to increase, corn itself is in higher demand, then there may be a higher demand for nitrogen.

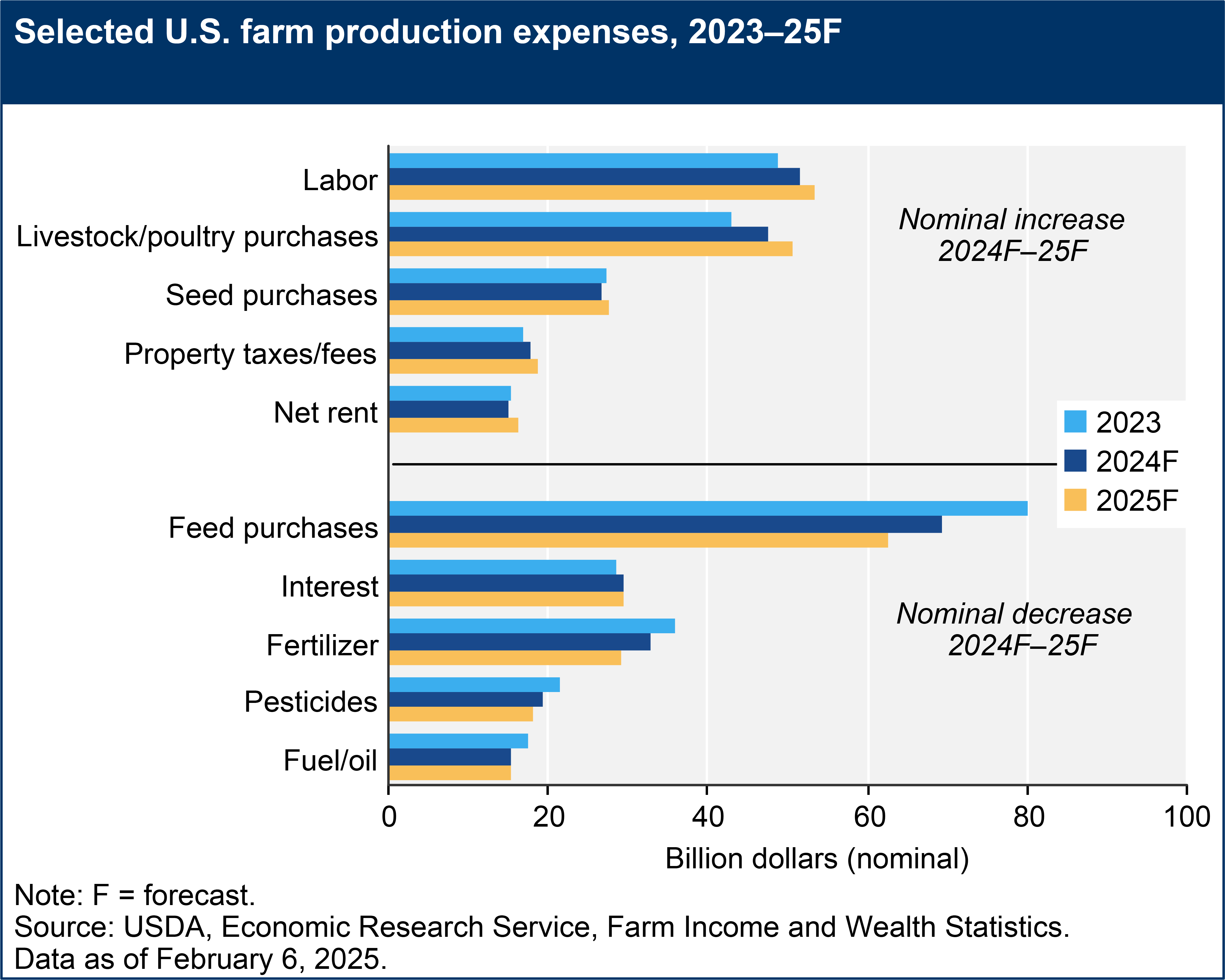

Other factors can also influence the demand for a product, such as supply chains and commodity prices. For example, natural gas is used in the production of nitrogen fertilizers. Natural gas is also used as a heating source for many homes in the country. In years of colder winters, there may be a higher demand on natural gas, which can influence the price on nitrogen.

Because of the connections to natural gas and corn, nitrogen fertilizers are highly correlated to trends in both natural gas and corn prices (Figure 2).

Figure 2. Correlation between nitrogen and corn prices. Schnitkey, G., N. Paulson, C. Zulauf, K. Swanson and J. Baltz. "Fertilizer Prices, Rates, and Costs for 2023." farmdoc daily (12):148, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 27, 2022.

Figure 2 illustrates seasonal patterns for natural gas and corn, which can help provide indicators of price directions for fertilizer. However, long-term market outlook on corn is unclear, raising concerns for producers when making buying decisions. Natural gas offers some information but does not solely address expectations on fertilizer prices. For more information on natural gas price outlooks, visit the Short-Term Energy Outlook report website: https://www.eia.gov/outlooks/steo/report/winterfuels.php.

Declining commodity prices can push demand towards lower input costs. The rationale is that as commodity prices decline, concerns of eroding farm profits increase. Less profits are often seen as a signal of less product demand. However, if demand remains strong enough and input costs stay higher, waiting to buy may be a better option.

Long-term commodity projections often lean towards lower prices unless production estimates significantly change. A significant change is often brought on by global or domestic events. These events can include global trade, wars, or poor weather such as drought. However, sometimes those changes take time to develop. For example, in 2023, many parts of the country experienced drought in the early summer months. But it remained unclear how drought conditions would impact commodity prices.

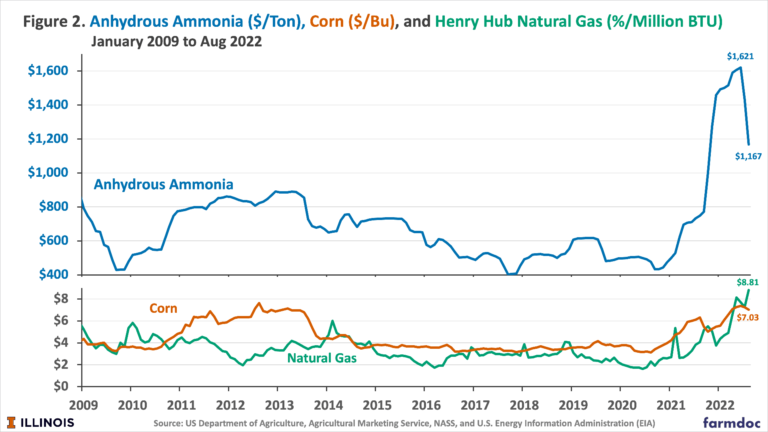

When uncertainty exists in the markets, explore other options to assist your decision-making. One such option is to compare differences between current and historical prices. For fertilizer purchases, a crop-to-fertilizer price ratio helps consider short-term profits compared to product use. The fertilizer nutrient price ($/lb.) is divided by the crop price. Crop prices are then adjusted to a per pound value. For example, corn prices are divided by 56, while soybeans are divided by 60. A higher price ratio indicates a more expensive fertilizer (Figure 3).

Figure 3. Corn to Nitrogen Price Ratio from 2021 through 2025 compared to Urea Ammonium Nitrate (UAN) 28% prices.

In Figure 3, producers in 2022 and 2024 were better off if nitrogen purchases were made in the fall versus the spring (ratio of 7.04 and 6.85 versus 8.84 and 8.76, respectively). The opposite was true for 2023 when purchases were better in spring compared to fall (ratio of 8.11 versus 8.25). Compare the current crop-to-fertilizer price ratio to projected crop and input prices to help identify whether to buy now or wait until later.

For current pricing information, speaking with local retailers is the best place to start. USDA also offers bi-weekly reports on production costs through the Agricultural Marketing Service (AMS): https://www.ams.usda.gov/market-news/production-cost.

Supply

Supply is another key component to understanding market conditions. While some of the inputs used on farms are manufactured in the U.S., many of them are imported from other countries. In cases where there is domestic production, it may not be sufficient to meet farm needs.

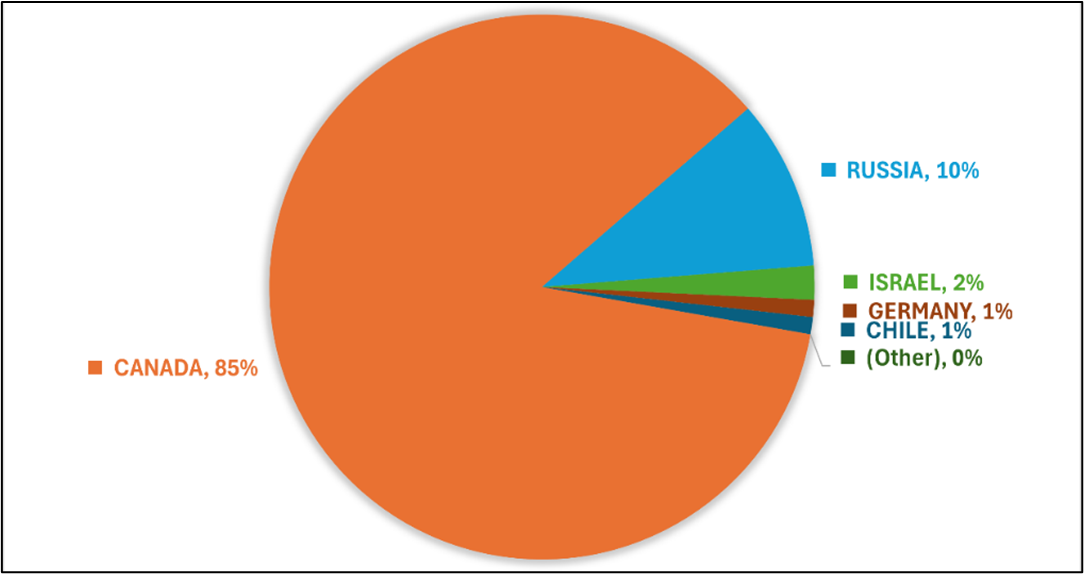

The U.S. Geological Survey releases an annual Mineral Commodity Supplies report on minerals, including fertilizer (https://www.usgs.gov/products/publications). The report stated that in 2023 only 8% (430,000 metric tons) of total potassium fertilizer use was produced within the United States. The remaining 92% was imported from other countries. According to the USDA, most imports of potassium come from Canada (Figure 4).

Figure 4. 2024 U.S. potassium imports by country of origin. Source: USDA Fertilizer Transportation Dashboard, https://agtransport.usda.gov/stories/s/dtqv-e4ux.

Global impacts on supply are increasingly important when farm inputs are imported from other countries. If a country unexpectedly lowers production, prices can dramatically increase. Conflicts such as war or poor trade relations can be equally harmful to product supply and prices. Understanding where farm inputs, or even their ingredients, come from can be helpful information. For more information, the Observatory of Economic Complexity offers data and tools to review many farm and non-farm products traded between countries (https://oec.world/en).

If demand is uncertain, supply may be your best indicator on whether to purchase now or wait. Communicating with local retailers is important to discover if products you need have potential supply risks and should be secured.

Identifying Needs & Maximizing Available Cash

Look at your crop plan to determine the amounts of each input needed because it is easy to calculate based on your acres and goals. Then look at your cash flow to determine what makes sense to purchase when. A monthly cash flow is best to help you pinpoint when cash is available and each input is needed. This will help you leverage your cash to help maximize your profitability and ensure ample supply.

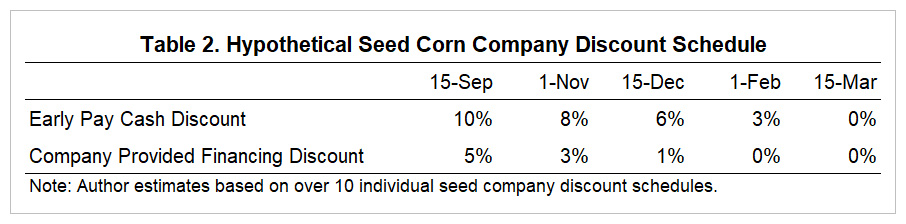

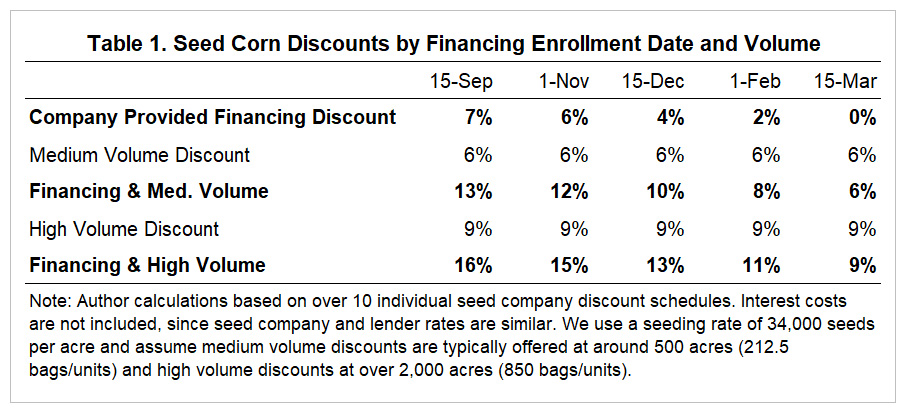

Are there discounts available on key products? Early purchase or financing discounts are often available for seed and chemistry (Figure 5). Deadlines for each discount should be weighed carefully as you decide what to buy.

Figure 5. Example of early pay and financing discounts. Fiechter, C. and J. Ifft. "Seed Corn Costs: How Do Discounts Work with Seed Company Financing?" farmdoc daily (9):191, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2019.

What products are needed in higher amounts? More cash is spent on products needed in large quantities, regardless of when purchases are made. More purchases, with smaller quantities, are recommended to spread out potential risk. But targeting large purchase products early maximizes your use of cash to secure them. Especially if purchases use on-farm storage and discounts.

Are there tax implications to your purchases? Each year, fall purchases are used to offset income tax liabilities. As you plan purchases, remember to maintain flexibility to maximize tax savings this year and next. Don’t overspend this year to save on inputs only to pay more income taxes next year.

When do you start to market your production? Maximizing cash isn’t just about what you have available now. Locking in favorable prices on production reduces concerns of lower revenues against higher input costs. The key to marketing while purchasing is having a good grasp of your farm’s cost of production.

To learn more about determining your cost of production, review MSU Bulletin E-3411: Introduction to Cost of Production and Its Uses (https://www.canr.msu.edu/resources/bulletin-e-3411-introduction-to-cost-of-production-and-its-uses).

Prioritizing Which Products to Buy

Equally important as maximizing your cash is prioritizing products you’ll buy first. Your crop plans, capital investments you’ve made, and market conditions are all key components of this process.

Figure 6. Examples of on-farm liquid fertilizer storage and seed silo storage. Photo credit to Nigel Jones for liquid fertilizer tank, https://commons.wikimedia.org/wiki/File:Liquid_fertilizer_tank_-_geograph.org.uk_-_526545.jpg. Photo credit to Alistair McLellan for seed silo storage, https://pixabay.com/photos/tungamah-agriculture-auger-5011633/.

Do you have on-farm storage? Farms that invest in product storage need to use them! Physical possession offers security that input needs are met. Especially when markets are volatile, and supply is uncertain. Storage facilities also can’t offer a return on your investment if they sit empty (Figure 6).

Are there availability concerns on certain products? Farm inputs, like seed and chemicals, are heavily influenced by annual availability. Prior to 2022, fertilizer supply often seemed limitless, but since then, supply concerns have become a yearly discussion topic. Prioritize obtaining inputs with supply risks to secure them for your farm.

Are alternative products available to meet your needs? Consider price differences between what you want to buy and what is available. Especially if alternatives allow you to continue using existing equipment and have minimal impact on application methods.

Create an Input Purchasing Plan

An input purchasing plan takes your crop plan and adapts it into an efficient buying strategy to secure products at affordable costs. Look at your crop plan’s acres, yield goals, nutrient needs and pest concerns. This will define what products you will need to buy.

Borrowing concepts from grain marketing (https://www.cffm.umn.edu/grain-marketing-plans/), input purchasing focuses on being intentional and proactive about buying decisions. Decisions include prioritizing use of on-farm storage, inputs with higher purchase amounts, potential supply risks and alternative product options. Most importantly, these plans help maximize available cash as you review buying opportunities.

A key question starting out is whether your approach to input purchasing is strategic or tactical?

Strategic vs. Tactical

A strategic plan focuses on buying farm inputs during the early buying season (often fall). With a longer period before planting or bud break, there are more opportunities to position input prices. Strategic plans also emphasize the use of cash availability, price saving tools, and consider income taxes. Income tax management is important to ensure any purchase savings are not lost to income tax payments. Final buying decisions are based on best value and long-term market indicators.

A tactical plan focuses on purchases in late buying season (often winter or spring) when less opportunities exist to position prices before planting or bud break. Less cash and price saving tools are often available during these periods. Final buying decisions should be responsive to market conditions and focus on securing remaining input needs at best possible values.

The type of plan you create impacts your plan goals.

Plan Goals

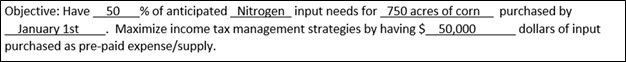

All plans must have realistic and reasonable goals. For buying inputs, a primary goal is to secure input needs at lowest possible costs. Additional goals may be to ensure flexibility for income tax management and secure portions of total input needs by a specific date.

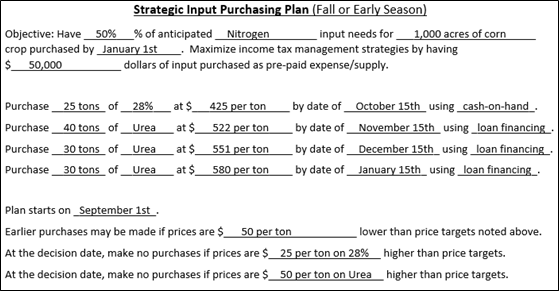

For example, 50% of nitrogen will be bought by January 1st and at least $50,000 of pre-paid expenses for income tax management (Figure 7).

Figure 7. Example of plan goals in a strategic input purchasing plan. Photo by Jon LaPorte, MSU Extension.

For a starting point to determining your plan goals, review the Identifying Needs & Maximizing Available Cash and Prioritizing Which Products to Buy sections of this document.

Quantity Objectives

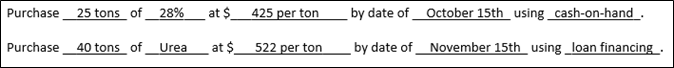

Each purchase has a set amount of product that moves total purchases closer to meeting plan goals. More purchases, with smaller quantities, help to spread out potential risk. Multiple purchases also allow you to continue to evaluate market conditions. If prices rise, you have secured some products at a lower value. If prices fall, you have invested a limited amount of cash at higher prices.

For example, a farm raising 1000 acres of commercial corn has a yield goal of 180 bushels per acre. It calculates a nitrogen need of 144 pounds or 144,000 pounds total. It will use a mixture of Urea Ammonium Nitrate (UAN) 28% and Urea between planting and side-dress applications.

The UAN 28% is used in starter fertilizer at planting and the farm will need approximately 43 tons. The remaining nitrogen will be spread in-season, and the farm will need over 130 tons. The farm has on-farm storage for UAN 28% and can hold 25 tons. They don’t have storage for dry fertilizers but can pre-pay without taking delivery. To utilize storage, the farm sets quantity objectives of buying 25 tons of UAN 28% by October 15. They will also pre-pay 40 tons of Urea by November 15 (Figure 8). Additional purchases will be made considering price saving tools and anticipated target prices.

Figure 8. Example of quantity objectives, pricing targets, and decision deadlines in an input purchasing plan. Photo by Jon LaPorte, MSU Extension.

Price-Saving Tools

Price-saving tools are often referred to as discounts because they lower the cost on farm inputs. Discounts provide incentives to make purchases sooner rather than later. In many cases, the largest discounts are often available in the early part of the buying season. Common examples of discounts are financing, cash, and quantity discounts.

A Financing discount reduces the overall price of the product being purchased. Financing options offer reduced interest rates or discounts on total dollars. Interest is still charged on borrowed funds at reduced rates. In some cases, 0% interest may be available for discounts in early purchasing months. Later purchases may be charged the U.S. prime interest rate (https://fred.stlouisfed.org/series/DPRIME) or prime plus a percentage. Price targets should consider the net effect of reduced costs from discounts and increased expenses from interest charges.

Cash discounts are offered as an incentive to avoid the use of financing. Retailer suppliers prefer cash payments because they have immediate access to cash and reduced processing fees. Cash discounts tend to be higher than financing discounts, making their use beneficial to farms with sufficient cash-on-hand.

Quantity discounts are offered in exchange for securing a portion of your input needs. The availability of quantity discounts can be a significant source of savings. Often, the savings from quantity discounts can justify the time invested in purchasing plans. Especially if your crop plan calls for a large amount of certain products. In some cases, quantity discounts are combined with other discounts to maximize price savings (Figure 9).

Figure 9. Example financing and quantity discounts for seed corn purchases. Fiechter, C. and J. Ifft. "Seed Corn Costs: How Do Discounts Work with Seed Company Financing?" farmdoc daily (9):191, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2019.

Pricing Targets

A target price is a value you find acceptable and are willing to buy products, if available. Baseline targets should consider market expectations, starting with comparison prices from at least two retailers. Factor in available discounts (Figure 3) to identify what markets are offering. Lastly, compare inputs to expected commodity prices to see if potential profits offset purchases.

Setting a baseline price based on when you typically buy certain products can help with planning. Targeting prices below the baseline, earlier on in the buying season, helps to identify pricing opportunities (Figure 10). If products are available at prices below your baseline, you can consider whether to make a purchase earlier than normal.

|

Product |

Quantity |

Month |

Price Baselines |

Pricing Target |

|

Urea (46% Nitrogen) |

40 tons |

October-Nov |

Baseline -10% |

~$522/ton |

|

Urea (46%) |

30 tons |

December |

Baseline - 5% |

~$551/ton |

|

Urea (46%) |

30 tons |

January |

Baseline |

~$580/ton |

|

Urea (46%) |

30 tons |

February-March |

Baseline +10% |

~$638/ton |

Figure 10. Example of pricing targets on Urea, a product containing 46% nitrogen.

Note: With a strategic plan, you can be more selective with pricing targets to gain bigger discounts. With tactical plans, it is difficult to be selective when you are closer to planting or bud break and need production inputs soon.

Decision Deadlines

Throughout many of the examples shown in this publication are dates showing when a decision will be made. Decision deadlines keep plans moving forward. Working with pricing targets, these dates encourage you to buy inputs or wait. If prices meet targets at a deadline, make your planned purchase. If prices are above targets, don’t purchase and move on to your next decision deadline. A third option is to buy if prices are close, and availability is a concern. Pay attention to seasonal patterns and market changes to decide which option is best (Figure 11).

Figure 11. Example of a "strategic" input purchasing plan. Photo by Jon LaPorte, MSU Extension.

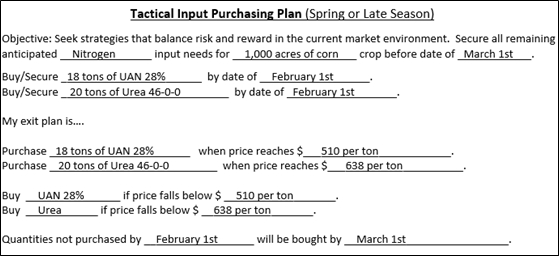

As plans shift to a tactical focus, pricing targets continues to be important but securing inputs is now your top priority. Having an “exit date” ensures you complete your plan with all input needs secured (Figure 12).

Figure 12. Example of a "tactical" input purchasing plan that focuses on purchasing remaining input needs. Photo by Jon LaPorte, MSU Extension.

Closing Thoughts & Resources

Input purchasing starts with your farm’s cropping plan. Crop plans help define what products you will need to buy. Once you know what inputs to purchase, then you can focus on how to minimize farm input costs.

Strategies to minimize farm input costs require an understanding of market conditions and expected prices. A conversation with local retailers about current prices helps identify options to minimize costs. Once identified, you need to analyze which options are best for your farm.

Also, remember an important trend about farm input prices: as commodity market prices are trending upwards, input prices tend to follow quickly. A higher demand for a product often brings with it an equally higher demand for inputs needed to produce it. However, when commodity prices decline, input prices are not as quick to follow. The lag time for many input prices to follow commodity markets impacts all farms, regardless of whether you raise field crops, forages, fruits or vegetables.

Input purchasing plans help you to remain intentional and proactive about securing needed farm inputs. Determining your goals, product quantities, and target prices put your knowledge of the markets into action. Price-saving tools and decision deadlines help you to capture the best available values for needed inputs.

To help weigh product options as you build your plan, consider using decision tools offered by MSU Extension. Decision tools help to consider different products and their impact on farm profitability. Options include seed selection, IPM strategies and meeting nutrient needs. Each tool is listed in the additional resources section at the bottom of the page.

MSU Extension has also created resources to help producers develop input purchasing plans. Templates are available in both Microsoft Word (https://www.canr.msu.edu/resources/input-purchasing-plan-template-word) and Microsoft Excel (https://www.canr.msu.edu/resources/input-purchasing-plan-template-excel).

Additional Resources:

USDA Agricultural Marketing Service Bi-Weekly Production Cost Reports

https://www.ams.usda.gov/market-news/production-cost

USDA provides bi-weekly reports on fertilizer product and fuel costs from various states.

USDA Fertilizer Transportation Dashboard

https://agtransport.usda.gov/stories/s/dtqv-e4ux

Provides information on U.S. fertilizer imports, inventory, and regional prices

MSU Fertilizer Cost Comparison Decision Tool (Field Crops)

https://www.canr.msu.edu/resources/fertilizer-cost-comparison-tool-field-crops

The decision tool helps consider how to meet field crop nutrient needs at the lowest possible cost.

MSU Fertilizer Cost Comparison Decision Tool (Forages)

https://www.canr.msu.edu/resources/fertilizer-cost-comparison-tool-forages

The decision tool helps consider how to meet forage nutrient needs at the lowest possible cost.

MSU Fertilizer Cost Comparison Decision Tool (Fruit)

https://www.canr.msu.edu/resources/fertilizer-cost-comparison-tool-fruit

The decision tool helps consider how to meet fruit crop nutrient needs at the lowest possible cost.

MSU Fertilizer Cost Comparison Decision Tool (Vegetables)

https://www.canr.msu.edu/resources/fertilizer-cost-comparison-tool-vegetables

The decision tool helps consider how to meet vegetable crop nutrient needs at the lowest possible cost.

MSU Pesticide Cost Comparison Decision Tool for Field Crops

https://www.canr.msu.edu/resources/pesticide-cost-comparision-decision-tool

The decision tool helps consider different products and their costs as you plan your field crop IPM strategies.

MSU Pesticide Cost Comparison Decision Tool for Vegetables

https://www.canr.msu.edu/resources/pesticide-cost-comparison-decision-tool-for-vegetables

The decision tool helps consider different products and their costs as you plan your vegetable IPM strategies.

MSU Seed Selection Cost Comparison Decision Tool

https://www.canr.msu.edu/resources/seed-selection-cost-comparison-decision-tool

The decision tool helps narrow down field crop seed options that offer yield and profit potential.

Print

Print Email

Email